Equity crowdfunding is a new way of raising capital for startups. Kickstarter has proven a successful model for crowdfunding an idea (by pre-selling the product). Equity crowdfunding takes this further by allowing the crowd to buy shares in the company itself. The volume of alternative finance for startups, entrepreneurship and innovation is growing rapidly.

Crowdfunding is a delicate balance of describing the product, the team, the business and the investment opportunity. Each of these need to be communicated in a clear, compelling and persuasive way. Often the teams with the best technical skill are not the best communicators.

Equity crowdfunding is awesome, but it’s hard

Raising capital on a crowdfunding platform can be one of the most wonderful and powerful things that a startup can do. But if it fails it can be painful. And the failure is public.

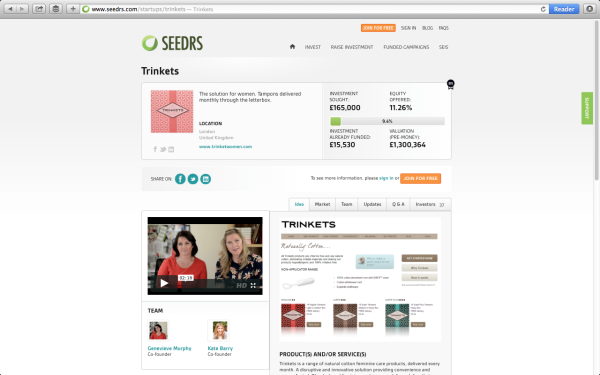

It hurts me to see wonderful companies that should be successful in raising capital but who don’t succeed because their idea isn’t explained in a persuasive enough way. For example, I fell in love with the Trinkets team at an in-person Seedrs pitch event. The business provides an online mail-order delivery of tampons and feminine products. They are raising capital through a funding round the equity crowdfunding platform Seedrs.

The passion, credibility and experience of the team really came through in person. But their crowdfunding campaign isn’t going as well as it should. I wish that there had been a book the team could have read on how to do a good crowdfunding campaign, services to help them and even an agency that could have crafted their campaign to be as successful as it should have been.

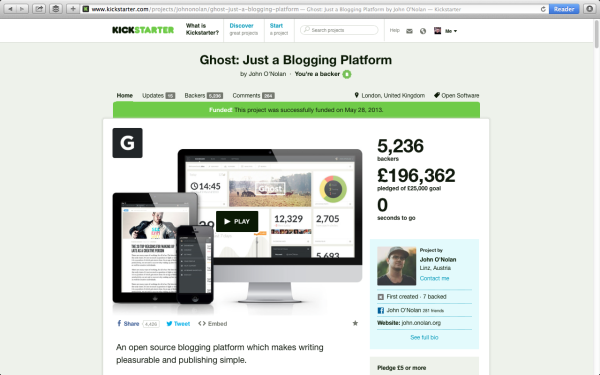

The crowd can provide a rapid injection of cash, mentoring and a network of fans. Product based campaigns on Kickstarter have proven the willingness of the crowd to invest significant cash. Campaigns such as Ghost (blogging platform), Kano (Computer kit-set) and Pebble (Programmable watch) have set the bar high for professionalism, design and pr to attract the crowd.

Successful equity crowdfunding campaigns need a great product, great business and great promotion of the campaign. The new world of equity crowdfunding requires a complex set of marketing, communications and business skills that could put a heavy drain on a startup unless they had outside help.

How to make an equity crowdfunding campaign succeed

The things that startups find hard about crowdfunding are things that communications professionals are already good at. Communicating with potential investors on a crowdfunding platform is very similar to communicating with potential customers.

The field of equity crowdfunding platforms are still pretty new so the best practises for setting up a campaign, promoting it and following up are still not well known. The main elements include:

- Video: Telling a compelling personal story about the company and the product is vital to crowdfunding.

- Imagery: Diagrams and photos bring the product to life so that potential investors can understand what they’re investing in.

- Text: The descriptions are where the rational information like market sizing, business plans and team credibility come to life.

- Numbers: Even if the financial plans are unlikely to come true they can still be an important part of painting a picture of the business model and market size.

Who could help startups be better at crowdfunding?

As far as I can tell, there aren’t many people out there that can help startups raise capital from the crowd in this new way. There are a smattering of pitch coaches, accelerators and small PR agencies. But no one is taking a leadership role in this space. People who could be helping (but aren’t) include:

- Investment banks built their businesses by finding people with money and connecting them to people who needed money to grow. They could help startups be more rigorous in their crowdfunding campaigns.

- Marketing agencies built their businesses by helping people with a product tell their story better. They could help startups be more persuasive in their crowdfunding campaigns.

- Investor relations and corporate communications agencies are good at explaining the benefits of an investment to sophisticated investors. They could help startups be more investor focused in their crowdfunding campaigns.

All of these firms could contribute really powerful things to help make good startups more successful at raising capital. This would help increase the success rate for good companies and eventually disrupt the capital markets by making more funding available to small, fast-growing companies.

Helping startups with crowdfunding campaigns might be a good fit for bigger firms, agencies and consultancies because they could take a commission on the capital that is raised, so the pay-off is much quicker than the current model of working for free and getting a small slice of equity.

Crowd-fund-a-thon weekend

These days, an intense weekend sprint is an effective way for small teams to get things done. Hackathons are a great way to have massive impact in a short space of time. I call a hackathon to create a crowdfunding campaign a crowdfundathon.

Investment, marketing and communications professionals could mentor startups in an intense burst to create a crowdfunding campaign. The participants would create their promotional videos, craft their pitch and set plans for how to promote their campaigns.

Help me find people who are doing this (or want to)

I’m currently doing a deep dive on what makes a successful equity crowdfunding campaign and I’d love to hear from:

- Startups that have raised capital through equity crowdfunding or considered it and didn’t bother.

- Professionals that work in investment banking, marketing agencies or investor relations who wish that they could be more involved in the startup community (but maybe haven’t been able to make it fit with their existing business model).

I’m organising a series of events in 2014 where startups can create their equity crowdfunding pitch in a weekend. With the right support, a startup could create everything they need in a single intense burst during a crowd-fund-a-thon.

If you know anyone who is raising capital or could help make startups better at capital raising then email me at: crowdfunding@peterjthomson.com

Interesting idea but in my experience the corporate world is not particularly well suited to supporting crowdfunding propositions. The key is to understand the thinking of the crowd investor and to pitch in terms that they understand, not the business-speak typical of the corporate world.

The problem is that most startups don’t have the core skills to take an idea and convert it into a viable business. The quality of their pitch is generally a measure of their business competence at any given time. Succeeding in raising funding is part of their right-of-passage from idea to business.

Intense weekend crowd-fund-a-thons wouldn’t solve this problem and in-fact would do the participants few favours as they could raise unrealistic expectations.

The truth is that there are a comparatively small number of well prepared startups, with specific types of offering, that put together a great proposition targeted directly at crowd investors and mount a successfully orchestrated crowdfunding campaign. You can’t do this in a weekend.

As the crowdfunding market grows, pitches will need to be better and more outstanding to succeed. We need to provide longer-term coaching in the core skills needed to reach this level.

OK, most startups won’t get over this hurdle but this is part of the filtering process that all new businesses must go through.